Economic growth creates ample opportunities for entrepreneurs. With increased demand across key sectors and its domino effect into every small subsector, anyone with good ideas and the ability to organize a ‘production’ that yields surplus (after paying off the supply factors) can become an entrepreneur and a successful one too.

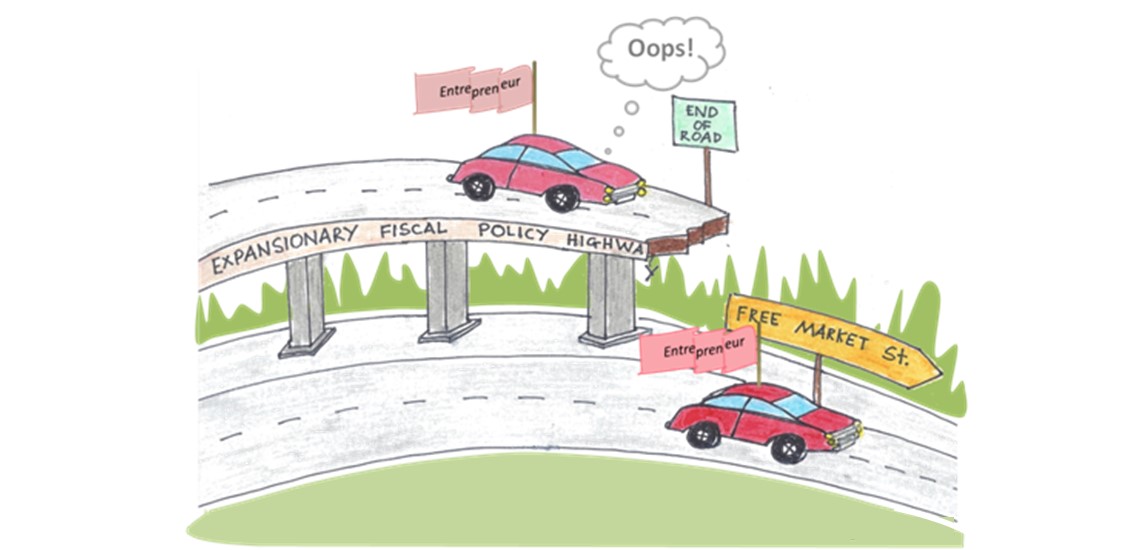

The question is, if the said economic growth is the result of aggressive expansionary fiscal policies which aim to keep the economy bolstered over a longer period, will it really enhance entrepreneurship or will it actually impact it in the opposite way?

The real effect of course has to be studied based on the fiscal mechanism that is used. If demand side tools are employed, with continuous government spending in all sectors and that too, on huge one-off capital projects, the boost for entrepreneurial activity will be felt almost immediately with sudden high demand in all support sectors – construction, transportation, financial, business services, telecommunications and retail. The core sector that the project is involved in will undoubtedly record the highest demand, producing opportunities for hundreds of small and medium businesses to sell a multitude of goods and services. Many entrepreneurs will be born in that short time, making strong gains almost within 1-2 years of registration (or incorporation if they are bigger) with huge potential for expansion in years to come. The situation will continue over a longer time if the government, via its budget balancing acts, continues to sustain huge expenditure and the many entrepreneurs go on tapping into the generous flow of business opportunities.

All is well until the budget starts to tighten and the government finds that time has come to ease spending. After all, everyone has had a good party and it is time to exercise prudence and restraint across our usual patterns of living and spending. The entrepreneurs who were earlier convinced that they do have the ability to organize ‘production’ that creates tradable surpluses, find the market betraying them and realise that their recent capacity and capability enhancements involving capital investments that come with huge interest repayments, hurting their businesses as demand suddenly declines and their respective sectors declare the onset of recession. The effect on entrepreneurship when this happens is twofold:

- Firstly, it signals to the market that entrepreneurship is a short term venture – one does not ‘build’ a business over the long term, one captures a one-off opportunity and makes the most out of it by organizing a ‘project’ rather than sustainable operations; and

- Secondly, organic entrepreneurs (people who tap into natural opportunities in a pure free market) will be discouraged from organizing their exceptional ideas/capabilities into production and going to the market.

However, entrepreneurship in any form or for whatever reason surely has its merit. The impact of entrepreneurship on growth – economic, social and politics – is all too well known in today’s competitive world. It does the following wonderful things in any economy:

- It fills up real gaps in human needs by producing the next thing or service that people have a serious need for;

- It enables the benefit of innovation, invention, creativity to be passed to society and in doing so, contribute to the advancement of the human race;

- It enables old economic and social hierarchies to be redefined based on a person’s ability to create value rather than inherited legacies; and

- It generates ample employment and more demand and in doing so, keeps everyone engaged in productive activity, creating prosperity

Demand-side expansionary policies may help create more entrepreneurial activity, but because they depend on continuous spending by the government and are focused on pre-identified sectors, they become unsustainable beyond a certain period (failing 3 and 4). As they are based on planned government spending, the gaps in human needs that they fulfill are policy-influenced and not actual needs (failing 1) and innovation that comes out of the activity may not be that usable when the market returns to its long term equilibrium where simpler, less costly solutions that befit slow, steady growth periods will be much more preferred.

Supply-side intervention however, produces the opposite effect. If the government lowers marginal tax rates with further tuning of rates according to sub-sectors, size and stage of the business and strategic interests, many viable entrepreneurial ventures will start going to the market. This is especially so if supply side policies reduce the cost of doing business and create a business friendly environment. Supply side policies allow greater degree of control on the types of businesses allowing more favourable treatment to be accorded to entrepreneurial ventures with high social benefits and minimum social costs.

These policies influence micro-level production decisions in terms of choice of locations, resources, types of businesses and use of original ideas and innovation. They also single out entrepreneurs who are able to create surplus from their ability to leverage on organic demand conditions that are independent of huge third party spending, be it government spending or huge incoming investments such as the FDIs. These entrepreneurs are the engines of sustainable growth in any environment.

Malaysia and elsewhere, businesses bolstered by continuous government spending may start feeling the pinch once a more balanced budget is pursued.

Short term entrepreneurial projects will see a quick end, but those who have built their businesses for the long haul based on market fundamentals will out-survive the others and prove to be the real entrepreneurs. Serial entrepreneurs might argue that entrepreneurship is the ability to create value, be it in the short term or long term, but if the entrepreneur lacks adequate knowledge in managing the financial and legal aspects of running the venture, winding up one business and registering another may prove not only to be an unwise decision, it will also cost a lot more than one had expected.

In short, as some businesses fade away, many more high quality ventures are waiting to hit the market. With a little fine tuning in the supply side policies and deregulation of sub-sectors with huge growth potential, the government can expect to tap into fresh entrepreneurial energies and create new growth opportunities to boost the economy in the mid and long term. In the short term however, some reality check will always help to reroute everyone to the desired growth objectives.